Growing Forage Crops -- What Does It Cost?

Do you know the cost of producing the forage you feed? For beef cattle producers, optimizing forage crop production is essential for financial sustainability. However, estimating the costs associated with forage production can be challenging. The new BCRC Forage Cost of Production Calculator can provide insightful estimates for cash, depreciation and opportunity costs of growing forage crops.

How It Works

The BCRC Forage Cost of Production Calculator is a user-friendly tool to assist beef cattle producers in estimating the costs associated with producing various forage crops.

By inputting specific parameters such as acreage, yield and inputs for a particular forage crop, as well as overhead costs in cash, machinery, building depreciation and labor costs, producers can estimate production costs for existing fields.

The calculator can be used for both perennial and annual forage crops. For perennial crops, variable costs in the establishment year are entered separately from the subsequent productive years; while for annual crops, only the average annual cost is needed.

Key cost components considered in the calculator include variable costs, overhead costs, depreciation on machinery and buildings and opportunity costs for land, labor and capital. Expenses like seed, fertilizer and equipment are straightforward. Overhead costs, such as machinery and building maintenance, farm taxes and office expenses, as well as non-cash costs like machinery depreciation, land opportunity costs and unpaid labour also contribute significantly to production costs.

To compare different forage options, producers can input various forage crops potentially grown on the farm into a separate spreadsheet with corresponding whole-farm costs.

The following examples are meant to illustrate the calculation steps, rather than serve as a benchmark. Data used in this example is based on multiple sources including Hay Production Costs 2024 by Manitoba Agriculture, Alberta Crop Report by Alberta Agriculture and Irrigation, Winter Forage Market Price Discovery by the Saskatchewan Forage Council and the Canadian Cow-calf Cost of Production Network. Producers are encouraged to input their own numbers to tailor the calculations to their specific circumstances and achieve the most accurate and relevant results.

Example 1: Estimate cost of production of existing forage crop

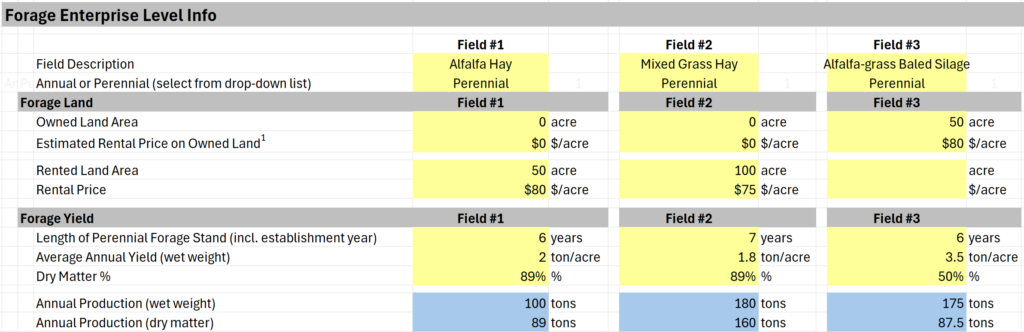

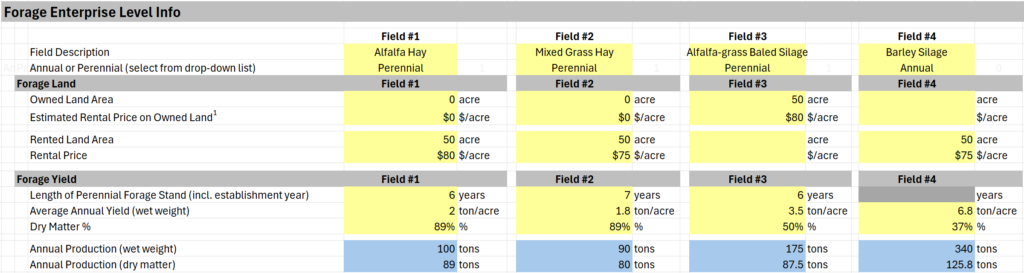

Consider a cow-calf operation in Western Canada with 200 acres of forage land (see Figure 1), including:

Field #1: 50 acres of alfalfa hay (rented), yielding 2 wet tons/acre at 89% dry matter (DM), which equals 1.78 dry ton/acre.

Field #2: 100 acres of mixed-grass hay (rented), yielding 1.8 wet tons/acre at 89% DM, which equals 1.6 dry ton/acre.

Field #3: 50 acres of alfalfa-grass baled silage on owned land, yielding 3.5 wet ton/acre at 50% DM, which equals 1.75 dry ton/acre.

Figure 1. Forage enterprise level information

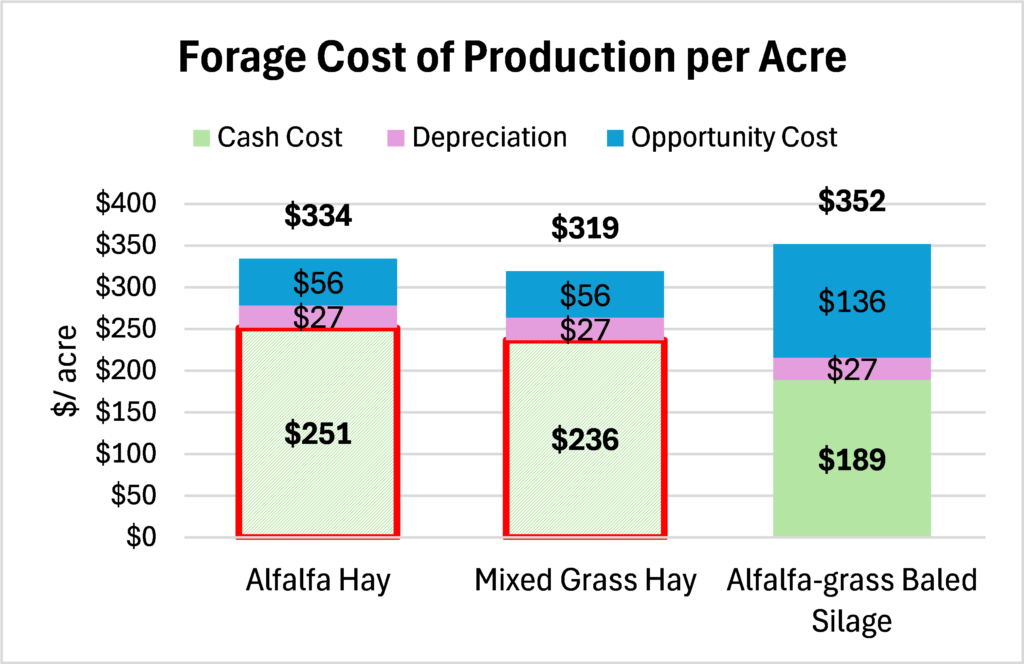

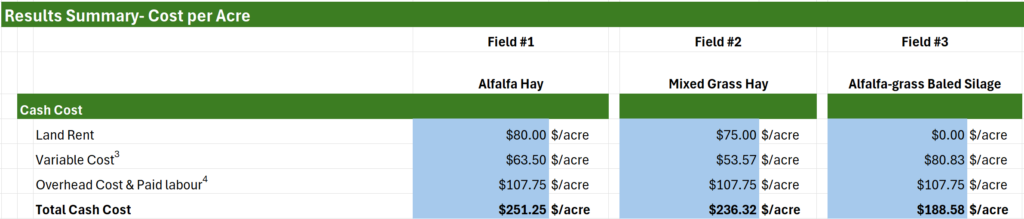

To begin, let’s look at cash costs for each field. Cash costs include variable cost, cash overhead expense, hired labour and land rent (see Figure 2).

Cash cost per acre is estimated at $251/acre for Field #1 (alfalfa hay), $236/acre for Field #2 (mixed grass hay), and $189/acre for Field #3 (alfalfa-grass bale silage). While cash costs per ton in dry matter are estimated at $141/dry ton for Field #1, $148/dry ton for Field #2 and $108/dry ton for Field #3 (see Figure 2 and 3).

Field #3 (alfalfa-grass baled silage) has the lowest cash cost because the forage is grown on owned land, eliminating land rent expenses.

It is worth noting that although Field #1 (alfalfa hay) has the highest cash cost per acre, its cost per ton is lower than that of Field #2 (mixed grass hay). While Field #1 has the higher cost per acre due to higher seed and fertilizer expenses during the establishment year, the higher yield per acre plays a crucial role in reducing production costs on a per ton basis. This highlights how yield advantage can lead to a lower cost per ton, despite a higher cost per acre.

Yield advantage can lead to a lower cost per ton, despite a higher cost per acre.

Figure 2: Estimated cash cost per acre and per dry ton

Figure 3. Estimated cost per acre and per dry ton – Example 1

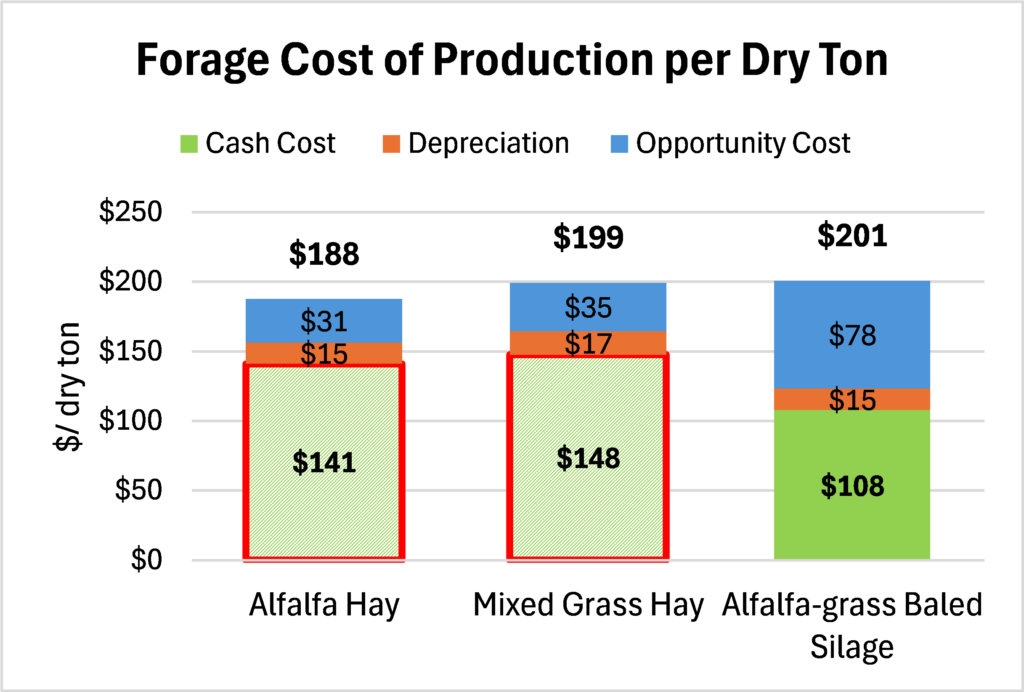

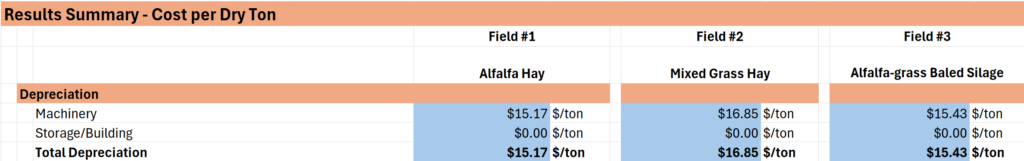

Depreciation, albeit non-cash, is an important expense to include when estimating costs. Depreciation represents money that should be put away each year to eventually replace machinery and buildings as they age and wear out.

The depreciation cost for the forage enterprise is estimated at $5,400/year. This converts to $15-17/ton DM across the three fields (see Figure 4).

Non-cash costs like machinery depreciation, land opportunity costs and unpaid labour are also significant contributors to production costs.

Figure 4. Depreciation cost per dry ton

In this example, building depreciation is assumed to be zero since the forage enterprise doesn’t use any buildings. On many farms, particularly in eastern Canada, depreciation costs for a storage facility may be significant due to the need to maintain quality in dry hay in a high-moisture environment.

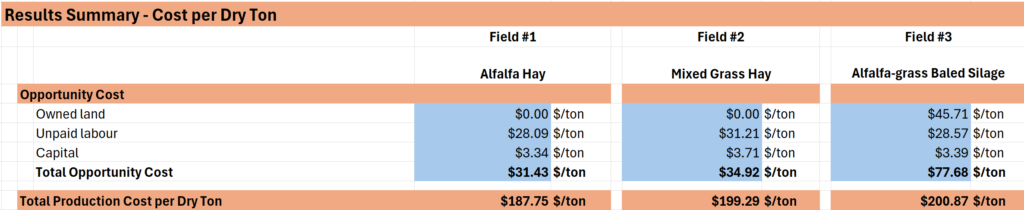

Regarding cost for unpaid family labour, this example includes unpaid labor of 2,000 hours annually at $20/hour. Assuming 25% of annual unpaid labour hours are dedicated to forage production, the estimated cost is $28-31/dry ton. For Fields #1 (alfalfa hay) and #2 (mixed grass hay), unpaid labor makes up the largest portion of total opportunity cost (see Figure 5).

For Field #3 (alfalfa-grass bale silage), farming owned land means forfeiting potential rental income, an opportunity cost for land of $46/dry ton (see Figure 5).

The opportunity cost for capital is the expected return (3% in this example) for the money tied up in machinery and buildings for forage production. The opportunity cost for capital is estimated at $3-4/dry ton for the three fields (see Figure 6).

Figure 5. Estimated opportunity cost and total production cost per dry ton

Figure 6. Overall cost of production – Example 1

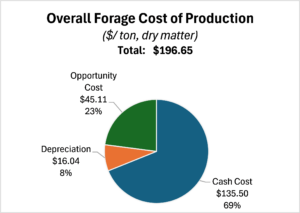

Taking all cash, depreciation and opportunity costs into account, total cost of production ranges from $188/dry ton to $201/dry ton across the three fields (see Figure 5). Although Field #3 (alfalfa-grass bale silage) seems to have the lowest cash cost per ton (see Figure 3), it has the highest total cost when factoring in the opportunity cost of owned land. This underscores the significance of considering non-cash expenses in forage production.

Overall, the estimated forage production cost for this farm is $197/ton DM, with 69% attributed to cash expenses, 8% to depreciation and 23% to opportunity costs (see Figure 6).

Example 2: Comparing a potential annual forage alternative

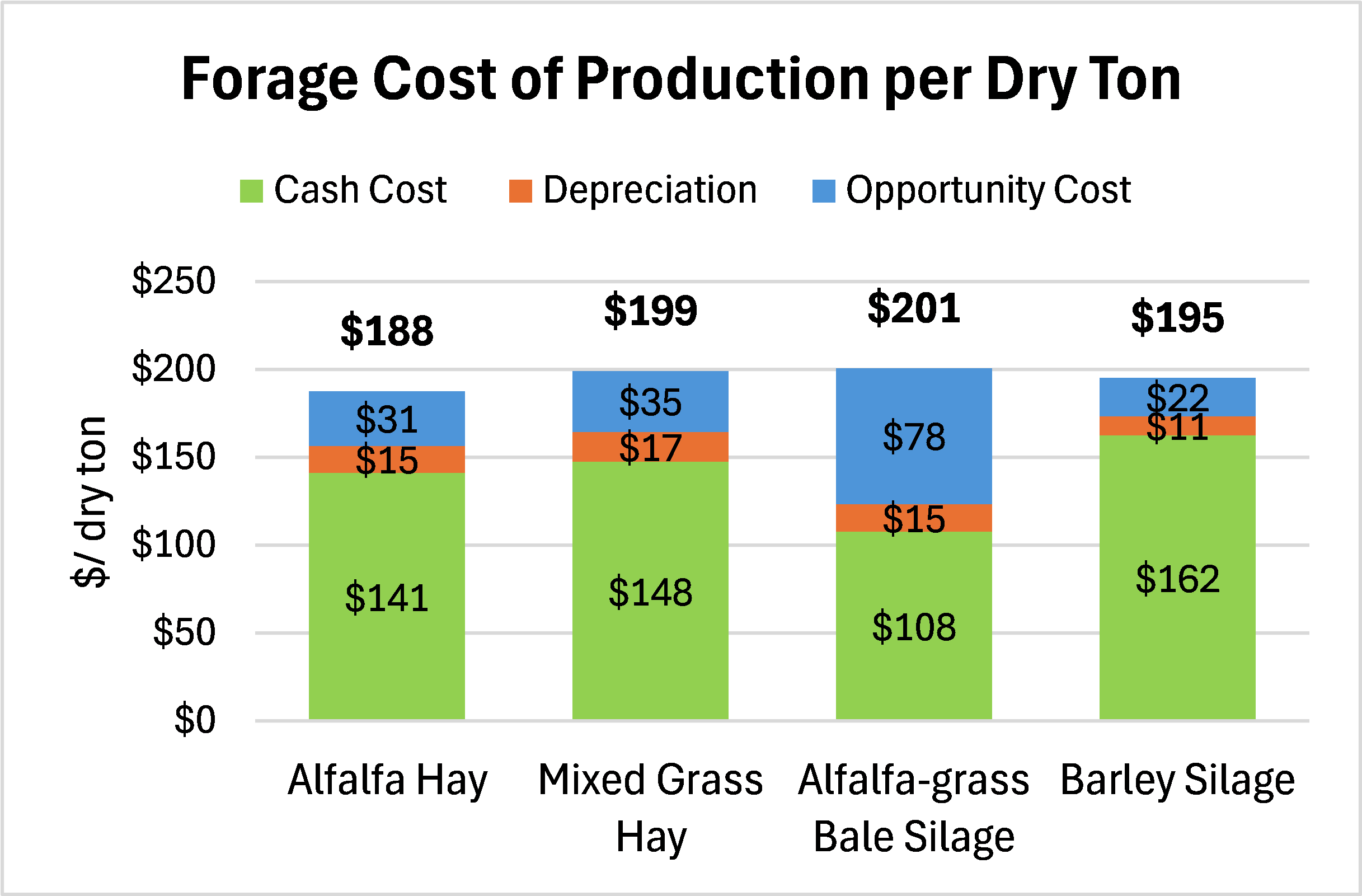

Expanding on Example 1, let’s consider a scenario where a mix of perennial forage and barley silage is produced from the same land base.

In this scenario, Field #2 (mixed grass hay) area is reduced by 50 acres and Field #4 is added for 50 acres of barley silage production, with an expected yield of 6.8 wet tons/acre with 37% DM (see Figure 7).

Figure 7. Forage enterprise level information – Example 2

The estimated variable cost for barley silage production is $226/acre, which include custom harvest and storage (see Figure 8). Keeping all other factors steady with Example #1, the estimated total production cost (including variable cost, overhead, depreciation and opportunity cost) for barley silage is estimated at $195/dry ton (see Figure 9). This estimate does not account for the cost of converting perennial to annual cropland. In the year of conversion, additional costs on plowing, spraying, fuel and labour need to be added to total expenses.

Figure 8. Estimated cash cost per acre – Example 2

Overall forage production cost is estimated at $196/dry ton, steady with Example 1. However, due to the higher cost per acre for silage production, annual cash cost in Example 2 increased 19% from $45,600/year in Example 1 to $54,200/year, indicating higher cash flow risk.

In addition, another risk related to silage production if using custom harvesting is finding a silage crew that can cut, chop and pack when your silage is ready to be taken off.

Silage production poses higher cash flow risks and potential challenges in finding a custom harvest crew, but it could potentially increase overall feed production on a limited land base.

Figure 9. Estimated cost per dry ton – Example 2

Despite these, total forage production on the same 200 acres of land increased by 13%, from 337 dry tons to 382 dry tons. This suggests that despite the higher cost per ton, converting part of the land to barley silage could increase overall feed production on a limited land base.

Other Considerations

These examples don’t consider cost variations associated with different feeding methods such as bale grazing vs. total mixed ration (TMR) or nutritional value variations among forage types. Additionally, non-economic costs and environmental considerations should also be considered when making production decisions.

Every farm is unique, and forage production costs can vary considerably. To gain insights tailored to your operation, try using the calculator with your own numbers.

learn more:

- Forage & Grassland Productivity (BCRC topic page)

- Forage U-Pick (BCRC decision tool)

- Cost of Production Guides & Calculators (Manitoba Agriculture)

- Hay cost of production worksheet (Ontario Ministry of Agriculture, Food and Rural Affairs)

Sharing or reprinting BCRC posts is welcome and encouraged. Please credit the Beef Cattle Research Council, provide the website address, www.BeefResearch.ca, and let us know you have chosen to share the article by emailing us at [email protected].

Your questions, comments and suggestions are welcome. Contact us directly or spark a public discussion by posting your thoughts below.